OK lets look at it this way. NO MA clustering, currently,

50 DMA @2049 should hold/ must hold.

MFI divergence area, room for it to come down a little with Mkt.

Tuesday, Dec 8th at 1:40 PM

I think wave E is still needed or ZIG-ZaG E

Most indicators are oversold.

Trending the SP500 SPX using proprietary cycles. A mechanical program (excel formula's) and the use of Advanced Get (Elliot waves) to both visually show what my spread sheet offers and how Advanced Get understands it. I'm also using a MOON COUNT that has been working nicely! Use at your own risk to supplement your own work. Jerry

Tuesday, December 8, 2015

Wednesday, November 11, 2015

Monday, October 5, 2015

diveragences were bullish but

Hello at 3PM Monday we are up some 78% since the last low. If you were an "AI" you wou;d take profits right here.

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=2&id=p64544581536&a=414238839

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=0&mn=6&dy=2&id=p64544581536&a=414238839

Tuesday, September 29, 2015

Today important day? 28th

I have today as a fib hit of 89 TD. +/-1 IF we take out 1867.00 then the wave 5 is in, doesn't have to be the low.

Could reset the cycles. 144 TD takes us into Dec 15th ish. I think we at least have a little bounce here.

Could reset the cycles. 144 TD takes us into Dec 15th ish. I think we at least have a little bounce here.

Sunday, September 20, 2015

Sunday, September 6, 2015

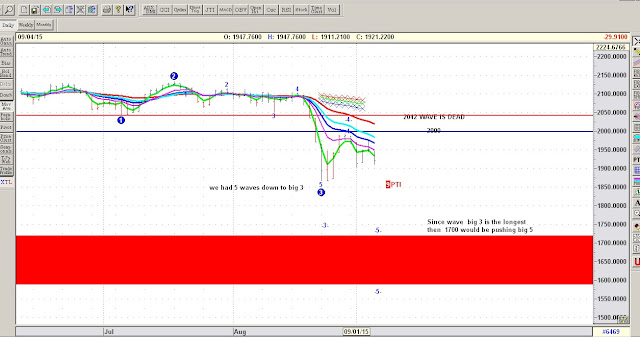

17.xx Spx in our future.

It just would'nt take that much to put us at 1789.Spx

The wave 5 could stop earlier, we do and AB then crash C

Thinking Sept 14th or 15th low.

Friday, August 28, 2015

Wave 4 rally should be over.

UPDATE Sunday nite.

I have no call other than wave 4 is unfolding and we head down to wave 5 lows

Jerry

The math on my spread says we had an EDT down close as pictured on a 5m

Here we see the wave 4 rally that should be over. Read the chart for direction and limits,right click will enlarge it! Jerry

Wednesday, August 26, 2015

Rally time

Update

3:35PM ET I think rally is a one day event just like the DAX.

**********************************************

I posted this at 4:20pm in email

Notice we closed at a double bottom so tried to buy an oex call since they trade till 4:15PM ET

price was 10.40 I put in for 10.50 and they keep going to $12.40

I don't have to look to know that futures are up.

I expect a rally tomorrow.

Late night check I see them up big time.

R1 is 1921

R2 is 1976.20 and I think it will be tested shortly.

Jerry

3:35PM ET I think rally is a one day event just like the DAX.

**********************************************

I posted this at 4:20pm in email

Notice we closed at a double bottom so tried to buy an oex call since they trade till 4:15PM ET

price was 10.40 I put in for 10.50 and they keep going to $12.40

I don't have to look to know that futures are up.

I expect a rally tomorrow.

Late night check I see them up big time.

R1 is 1921

R2 is 1976.20 and I think it will be tested shortly.

Jerry

Monday, August 24, 2015

Sunday, August 23, 2015

More down

Take a few days off and boom.

Last post I said rally would end shortly and looked for a

low on 28th to 4th.

We are in a wave 3 crash so it could be over before the 28th.

We should have new resistance at Spx 2070 and support at 1900.

I know many think that 1820 will fall here but I don’t

Using the Gann angles it offers Spx 1900

Sunday, August 16, 2015

Question: Are cycles stronger than technical’s? UPDATE

Update Monday close

Cycles won! We did 50 Spx points in 3/4 TD ( trade days)

Is there more to go perhaps but I'm in vacation mode. Rally will be over shortly. I won't put money down while I'am away.Here is a picture of my Static cycles as a guide and my Gann Wheel inspired

offset floating cycles. Happy trading Jerry NextLows (8-28,9-4)

Question: Are cycles stronger than technical’s? Sunday @4pm

Cycles won! We did 50 Spx points in 3/4 TD ( trade days)

Is there more to go perhaps but I'm in vacation mode. Rally will be over shortly. I won't put money down while I'am away.Here is a picture of my Static cycles as a guide and my Gann Wheel inspired

offset floating cycles. Happy trading Jerry NextLows (8-28,9-4)

Question: Are cycles stronger than technical’s? Sunday @4pm

Well I’am about to find out.

The cycle low came

last week as expected,but not the way I like it. Mostly it was too fast and unplayable in my mind,

because I count on a retest. I also count on technical's being over sold.The

MFI was close but others were mostly neutral.

I had the rally starting on the 14th but was

hedging because of the technical's.

If the cycles lead then next week will be up. If the

technicals lead and Friday hit a double top and a resistance zone then we will retest

Tuesday and scream higher.

I hate to read

reports if it doesn’t go up it will go down, but that is where I’m at.

Learning the cycle strength.

Jerry

Can you live for a month without the ATM?

Thursday, August 13, 2015

REtest Thursday

update after close:

First and intraday chart showing a firm buy at 12;20 of course I was at the DR. :(

OK Thursday! If I'm right it will be a high am low pm day.

We should test the low of SPX 2052 +/- 10 points.

Here is a chart with us in a wave 3 drop and next will be the rally to 2101-2113 to keep this count and no overlap.

I have been calling for this basing and rally for days. Today finally

my parabolic indicator and several counts said the low will be tomorrow. Upside target will be .618.----.78 Jerry

Market did nothing I expected today will remain flat. A mixed market has little details.

It can be bad for your financial health.

Keep my powder dry

First and intraday chart showing a firm buy at 12;20 of course I was at the DR. :(

OK Thursday! If I'm right it will be a high am low pm day.

We should test the low of SPX 2052 +/- 10 points.

Here is a chart with us in a wave 3 drop and next will be the rally to 2101-2113 to keep this count and no overlap.

I have been calling for this basing and rally for days. Today finally

my parabolic indicator and several counts said the low will be tomorrow. Upside target will be .618.----.78 Jerry

Wednesday, August 12, 2015

LOW finally close.

Email Monday close:

L"oo"ks like a short squeeze and momentum run

today.I think we reverse most of it.

One thing that makes me suspect is that the indicators fast

or slow didn't do that much..

Lets see.

Jerry

Tuesday night: close

Tuesday did reverse and the indicators did move down.

I would like to see Spx 2044 to 2067 Wednesday to get this

low over with. Depending on what happens Wed, low is either Wed-Thursday.

The system I use now has floating cycles, not static cycles.

Some one once said to me I did a “what if” and found it worked on Elliot Wave. I tried it on cycles and it seems to work. The

bases is, that I know where the next high should be but you have to have a high,

on in this case a low to complete the cycle before the next one starts.

Thus thinking the 14th would be a high, is now

floating to 17th to 19th at least.

Question? What if the ATM’s were shut down, would you have enough

cash.

You should have at least 3 months of cash hidden.

Monday, August 10, 2015

Lower maybe lost

Looking at Europe and the US futures tonight I see strength.

Is it because Abby Joesph Cohen was on an looks for Spx 2150 in months,or Birinyi Assoc. looking for Spx 3100 by 2017.

I read where the market is O.S.but AAII bulls +3.2 and bears drop -9.0.

I had felt Spx 2044 was coming this drop, and still possible since indicators turned down Friday.

Last several lows have come at 3 TD momentum of 416x and we are at 4177 but even with low cash in the funds we get these silly rallies.

I have just about run out of cycle time for a low.

By Wednesday a rally is coming.

Is it because Abby Joesph Cohen was on an looks for Spx 2150 in months,or Birinyi Assoc. looking for Spx 3100 by 2017.

I read where the market is O.S.but AAII bulls +3.2 and bears drop -9.0.

I had felt Spx 2044 was coming this drop, and still possible since indicators turned down Friday.

Last several lows have come at 3 TD momentum of 416x and we are at 4177 but even with low cash in the funds we get these silly rallies.

I have just about run out of cycle time for a low.

By Wednesday a rally is coming.

Friday, August 7, 2015

Low unfolding but could be next week

Here we have the Stockcharts !STVOSPX INDICATOR. It gave a sell yesterday when it crossed the MA. on the 5th. On the other hand my excel parabolic indicator calls for a low tomorrow the 7th.

Since the PI calls for a low tomorrow but I usually get a second PI signal I will go with the !S indicator.

If we don't get a lower low tomorrow then the low will move to early next week .

Jerry

Since the PI calls for a low tomorrow but I usually get a second PI signal I will go with the !S indicator.

If we don't get a lower low tomorrow then the low will move to early next week .

Jerry

Wednesday, August 5, 2015

Big drop this week!

Lets put up a chart of AAPL vs $SPX in red.

If AAPL is a leader and down yesterday $3.80 or 15% since its high then the stocks are going to stop pissing in the wind and drop. We had 2/1 declines,13NH/16/NL

If AAPL is a leader and down yesterday $3.80 or 15% since its high then the stocks are going to stop pissing in the wind and drop. We had 2/1 declines,13NH/16/NL

Sunday, August 2, 2015

Low week?

I have had this week as a low for a week. Now is the time. Monday we need to break 2097 very fast that should turn the indicators down.

Friday drop just put them in holding pattern.

Will add a few charts one will be weekly of the SPX and how close it is to dropping out of the channel.

The second shows what is a rounding top.

Friday drop just put them in holding pattern.

Will add a few charts one will be weekly of the SPX and how close it is to dropping out of the channel.

The second shows what is a rounding top.

Sunday, July 26, 2015

Monday key to how low we will go!

Just to show if 2039 to 2044 broke, we will be at 1980 very fast.

Hi,

I'm worried about Monday 27th. Friday’s drop was so big it moved my parabolic sheet ahead 1+ TD. Thursday as I posted I was looking for low retest on the 3rd 5th but now think 31st will re-test the low ( that is where we get long)

Monday now calls for a low/reverse. A check mark day or a V day.

I'm worried about Monday 27th. Friday’s drop was so big it moved my parabolic sheet ahead 1+ TD. Thursday as I posted I was looking for low retest on the 3rd 5th but now think 31st will re-test the low ( that is where we get long)

Monday now calls for a low/reverse. A check mark day or a V day.

Monday is a blue day Key times are

10:30 +/- 20m and 3:30. My guess is it will be a low am to high pm day.

The parabolic sheet is rarely wrong on low calls.

Problem all indicator are only 1/2 way into down stretch.

IE: We could double bottom Monday or plunge big time. Since my indicators are ½ way to a-low we need a big drop. If not any rally will be short lived

Jerry

The parabolic sheet is rarely wrong on low calls.

Problem all indicator are only 1/2 way into down stretch.

IE: We could double bottom Monday or plunge big time. Since my indicators are ½ way to a-low we need a big drop. If not any rally will be short lived

Jerry

Friday, July 24, 2015

Lower Next Week.

Hi All,

Today Thursday I said @ 11:30 am ET that 2110 needs to fall

but it held hard for a while.

Now that 2110 SPX has fallen I believe it is strong

resistance.

Friday is a wild card and I have no call!

I have a low next week and a retest of that low the week

after Aug 3rdISH to get long

for a sharp rally to 13-14th or 20-21 expiry more on this in a week.

How low could we go? Of course it will have to be find tuned

but 2075/2083 SPX looks do-able if this is a wave 4 correction. Lower than 2075

and this is no Wave 4.

I look for a momentum number of 4150- currently we are at

4221.

This is what Advance Get looks like.with 618 @ 2075 Spx

Wednesday, July 22, 2015

Tuesday, July 21, 2015

Tuesday 21st – Wednesday-22nd critical

Tuesday 21st – Wednesday-22nd critical

Tuesday we have Apple and Verizon earnings to mention a few

power houses.

Monday closed at the most Overbought level since Dec 30th

when we dropped 100 spx points in 6 TD.

Or back in Oct 27th where we went up 150 Spx

points in 30 TD.

SO Overbought doesn’t mean we will drop!!!!!!!!!!

My best guess is we will drop by Thursday this week at the

latest.

Jerry

Friday, July 17, 2015

Exuberance

Exuberance

Thursday close 16th, very close to new highs as

suggested. The OEX did hit a new ATH today. That makes me think we are getting

O.B. rarely does the OEX lead the SPX.

More highs Friday is a good place to nibble short, but early

next week maybe better.

Murphy Math people say a frame has shifted, I think a phase

has also shifted in the counts. Lows ran later and highs look to be running

later.

With that in mind I will place the next low on Aug 5th -2 TD.

Jerry

Wednesday, July 15, 2015

More highs coming up date 15th close

PIM by Jerry to Group, names will be hidden ,but my thoughts are real.

Thank you xxxx and xx.

Thank you xxxx and xx.

Looks like I was a little early and should have held for the

15th that I had posted on my blog. Of course profit is profit.

So here we are the 15-16th time frame and a xx

day to boot.

My problem is xx said today could be a High or low and of

course it maybe both.

I just don’t see us OB here

so we may or SHOULD have a Higher

high.

I don’t think we are there yet. I, right at 5:50PM ET think we go higher probably

into next week. When I say higher I mean sharply higher to ATH.

Look at INTC after market, so tech’s are hot.

xxxxx sent out some dates I want to study..

Good trading.

Jerry

Tuesday, July 14, 2015

Flat for now IRAN next.

Sold my calls today Monday rally. IRAN maybe the news Tuesday.

Iran aside I look for a little more rally Tuesday before we pull back to say 2080-88. The math says Monday is a EDT -D and the chart does offer some what of ending digital triangle look.

Charts offer more upside and the high could be the 16th new moon.

I have been using the 15th-16th as a best guess for last gasp high.

Working on where next low could be, next purchase will be puts.

Iran aside I look for a little more rally Tuesday before we pull back to say 2080-88. The math says Monday is a EDT -D and the chart does offer some what of ending digital triangle look.

Charts offer more upside and the high could be the 16th new moon.

I have been using the 15th-16th as a best guess for last gasp high.

Working on where next low could be, next purchase will be puts.

Saturday, July 11, 2015

Staying long!

Quote of the week- “Sometimes, when it’s too obvious, it’s obviously wrong.”

I like that

and have stayed long looking for 2100 Spx some time this week 15th

or 16th

would suit

me. I had this week picked out weeks ago as a high but let us see what it takes

to get over bought. This is opex expiry week and a good place for a high.

Next after

this week we will be looking out for the start of a decline and I think they

could be much faster than we are used too.

Jon Murphy

had a letter out this week with his Elliot Wave count, basically looking for a

wave 4 pull back and then wave 5 higher.

My Advance

GeT has us in a finished wave 5 and now in ABC corrections.

This is

important: We are at the 125 sma line. I don’t think it will be resistance but

if it is, back on Oct 15th 2014 we dropped 6.56% and if we do it again then the target would

be Spx 1950.

If 2040

falls then I had 1970-80 so 1950 would

be in range. I don’t expect that to happen yet.

Jerry Timingshortterm @ yahoo groups

Not

investment advice……………………………………………………………………..!

Thursday, July 9, 2015

Mother of a short Sqeeze starts July 9th

I said yesterday if we had an inside day we will rally.

Sure enough we had the inside day, out of many things the market could have done! That is the Wall Street code to rally.

It's all fixed, to screw the little guy, but the little guy can play too. To be clear I'm not saying every inside day is a buy only the special ones

I look for the mother of a short Squeeze to start Thursday and go until the 15th or 16th of next week.

Not trading advise. Do you own work and figure it out.

Jerry

Fun and games on the internet. :)

Sure enough we had the inside day, out of many things the market could have done! That is the Wall Street code to rally.

It's all fixed, to screw the little guy, but the little guy can play too. To be clear I'm not saying every inside day is a buy only the special ones

I look for the mother of a short Squeeze to start Thursday and go until the 15th or 16th of next week.

Not trading advise. Do you own work and figure it out.

Jerry

Fun and games on the internet. :)

Wednesday, July 8, 2015

Weird Day

I was hopping to see Spx 2098.63 by Wed but we may need to wait till next week.

Maybe I should be bearish but I'm not.

Why, well why aren't we down big time It looks like a market not ready to go down.

Sure future's are down big time again tonight @ 12:30 pm ET. China crashing and Asia weak.

My problem is on the 6-30 double bottom low we had heavy volume. Today point for point we had light volume moving us up from the low.

We are in a C wave, but where can you find a C wave that was also an outside day reversal?

Where is a C wave confirmed by 5 waves down.

Conclusion if Wed is flat and an inside day that will be bullish, or else we crash since this C can be a crash wave.

I remain long but with little confidence.

Maybe I should be bearish but I'm not.

Why, well why aren't we down big time It looks like a market not ready to go down.

Sure future's are down big time again tonight @ 12:30 pm ET. China crashing and Asia weak.

My problem is on the 6-30 double bottom low we had heavy volume. Today point for point we had light volume moving us up from the low.

We are in a C wave, but where can you find a C wave that was also an outside day reversal?

Where is a C wave confirmed by 5 waves down.

Conclusion if Wed is flat and an inside day that will be bullish, or else we crash since this C can be a crash wave.

I remain long but with little confidence.

Saturday, July 4, 2015

Staying Long for now.

Saturday Night July 4th. Watched a lot of local fireworks.

Many looked for mkt to tank on the Greek outlook before the long

holiday.

The Spx had plenty of chance to fail Thursday but put in a somewhat

flat day.

Even Friday July 3rd the Ftse and Dax didn’t fall

apart.

I don’t think the market will have a negative reaction to Greece again,

no matter how it goes this weekend.

The Spx market looks bullish to me but if we can’t take out

Spx 2098.63 by the 7th or 8th of July then we may have to

re-evaluate. These are not the dates I have a strong hit on but lets see what

happens by then.

So far everything I have is on a buy.

Jerry

timingshortterm yahoo groups not for training

Tuesday, June 30, 2015

End of Month rally coming.

Monday Close

Adx –DI at level seen only near 10-15-14,5-18-12,8-8-11 major

lows.

First blow out day I have had in 71 TD.

EDT possible calling for low tomorrow.

My parabolic indicator calls for low tomorrow.

So I had the 29th-30th picked for a

low. EOM window dressing coming.

Depending how low Tuesday is will tell the story. The –DI

could go higher (bearish) and the MFI (money flow has room to go down,bearish)

No new low up we go, if a new low it will be tested in days

if market is as weak as it appears.

My call- Of course we will open strong Tuesday but will it

hold? I think not with more of a chance to buy Tuesday.

This may not be about Greece,

but China

and Porto Rica.

Jerry

Wednesday, June 24, 2015

Worst days of Month

Update for Monday

Update

Sell off came with out Greek deal . Today Friday @ 12noon with mkt up I believe the low of this series will be Tuesday the 30th in the AM.

Jerry

The worst days of the month 19th to the 27th. Bear wize

I have a minor low, for 6-29,6-30 . Probably Spx 2078.44 the

150dma .

Short and sweet as Verizon say's I have run out of internet time sicUpdate

Sell off came with out Greek deal . Today Friday @ 12noon with mkt up I believe the low of this series will be Tuesday the 30th in the AM.

Jerry

The worst days of the month 19th to the 27th. Bear wize

A big sell off is due and I bet it will come when Greece accepts the deal!

Jerry

Thursday, June 18, 2015

1980-1990 Spx coming

Fed speak today was good. Does market like good news? NOOOOOO!

If we follow the Transports down then 1980-1990 is on tap .

Support/resistance temp. sold my calls today, holding only longer term puts as of tonight.

If we follow the Transports down then 1980-1990 is on tap .

Support/resistance temp. sold my calls today, holding only longer term puts as of tonight.

Monday, June 15, 2015

Major cycle low is due! -pondering update

Update 6-16 close. Sure 2072 was a double bottom.

Is it going to hold after Wed Fed rally?

Several indicator suggest this is a relief rally.

MFI and my proprietary parabolic didn't offer a low.

*****************************************************************

We have the 90d , 120 D and the 165degree cycle all due in this time frame +/- 2 TD

Is it going to hold after Wed Fed rally?

Several indicator suggest this is a relief rally.

MFI and my proprietary parabolic didn't offer a low.

| low 98.xx | next day hi odds | ||||||||

| hi is 101xx | High in 3 days hi odds | ||||||||

| I didn't see these numbers either | Jerry |

*****************************************************************

We have the 90d , 120 D and the 165degree cycle all due in this time frame +/- 2 TD

Friday, June 12, 2015

Still think rally is all smoke and mirrors!

Sorry I posted this last night to group but forgot Blog.

timingshortterm yahoo groups

These indicators/fractals look very close so if we are going to fail here, we need to open weak or double top and drop.

timingshortterm yahoo groups

These indicators/fractals look very close so if we are going to fail here, we need to open weak or double top and drop.

Sunday, May 31, 2015

Wednesday, May 27, 2015

HIGH odds low is Wed

Low Wednesday!

Every thing says' a low Wednesday. I would watch these numbers.

All Spx steps 2096.03, 2085.57, 2074.99

A close above 2126.07 would change the short term trend back up.

I will be more cautious if we spike higher on the open. Watch the Dax, and $$$

Every thing says' a low Wednesday. I would watch these numbers.

All Spx steps 2096.03, 2085.57, 2074.99

A close above 2126.07 would change the short term trend back up.

I will be more cautious if we spike higher on the open. Watch the Dax, and $$$

Friday, May 22, 2015

When !

Monday late night 9:23 pm

As I suspected I did both a moving average sell and a mechanical sell. MKt so jumpy may mean nothing.

As far as I can tell the priority indicator in DT5-DT7 has offered a sell and the bands do suggest strong resistance.

Friday 2:30 update

Thursday was an inside day considered bullish by me, but TA has been poor of late.

Possible we hit strong resistance today with a double top. Janet will rule Friday.

Here is Planet V in action on the SPX. This perfect sell was 12-29-14

@ spx 2090.57 losing 102.45 in 13 fibs days. 90 points was fairly captured.

When will we get there I don't know . Jerry

.

As I suspected I did both a moving average sell and a mechanical sell. MKt so jumpy may mean nothing.

As far as I can tell the priority indicator in DT5-DT7 has offered a sell and the bands do suggest strong resistance.

Friday 2:30 update

CTIX This is a $2.64 stock better then option. News it has expanded it trails on cancer drug, and this is at Harvard.

Sue any thing from you sources? I did buy some what the " H"

BTW if we close down ( spx) I will get a sell order. Does it mean any thing the way the TA works of late only time will tell.

CPI

@ .03 If burger worker get that $15 raise or some raise the price of

the $1.00 menu will go to $2.00. Pressure is building from the

bottom.

$10.00/$15.00 is a 66% raise

Jerry

Thursday was an inside day considered bullish by me, but TA has been poor of late.

Possible we hit strong resistance today with a double top. Janet will rule Friday.

Here is Planet V in action on the SPX. This perfect sell was 12-29-14

@ spx 2090.57 losing 102.45 in 13 fibs days. 90 points was fairly captured.

When will we get there I don't know . Jerry

.

Thursday, May 21, 2015

WWW or some thing big?

Was it just another Weird Wally Wednesday or much more damaging. answer neither ! www is Wed is W of option expiry week, I stand corrected. updated

We had an outside day today bearish to me.

Volume was not telling neutral

Higher high them give it up is not bullish usually

MFI gave a sell chart below.

Is it a EDT? bearish chart below with sample.

Wave 5 for sure topping

3rd chart down, the trans ports ugg bearish

Please view this chart a lot of distribution today! bearish

http://www.wwfn.com/crashupdate.html

We had an outside day today bearish to me.

Volume was not telling neutral

Higher high them give it up is not bullish usually

MFI gave a sell chart below.

Is it a EDT? bearish chart below with sample.

Wave 5 for sure topping

3rd chart down, the trans ports ugg bearish

Please view this chart a lot of distribution today! bearish

http://www.wwfn.com/crashupdate.html

Thursday, April 23, 2015

Cycle high

Weekend and first of Month.

Still look for 2044 Spx this week. Full Moon. Sell still in effect.Over bought. If we gap higher then I'm totally wrong.

Jerry O

*****************************************************************************

Wed 4-29 -15 close update

Broken record again. Received a MA sell and a mechanical color sell. No EDT buy this time.

We did have an inside day I usually consider that bullish, however we had a -16.68 drop in momentum vs a drop of 7.91 Spx points. That calls for a lower price. If the market was to follow the DAX level we would be at SPX 2044 or Spy 204.5. My call is a sharp down at some point Thursday.

Jerry EOM position challenge.

**************************************************************************

Monday close update.

Received a MA sell and a mechanical color sell . However you can count 5 waves down and a EDT signal also posted. I think we need to watch Dax for weakness, need at least Spx 2097 to get the bearish juices flowing. No charts tonight.

**********************************************************************************

Still think we are near a cycle high and one more day could put the MFI into OB and the DPO giving a better signal.

30 CD Cycle looks about right. On 2 -25 we hit a high and closed 6-8 points below the high.

On 3-23 high closed 6-8 points below high.

On 4-23 high close 6-8 points below high with following.

A cycle H+H+H look very good here. I expect a few days of strong weakness

.

Is this a top? Probably not because the 4.94% model would have us at Spx 2160 today.

I have a 4td MA on the MFI, very weak here. A better fit would have been O.B.

Jerry

Still look for 2044 Spx this week. Full Moon. Sell still in effect.Over bought. If we gap higher then I'm totally wrong.

Jerry O

*****************************************************************************

Wed 4-29 -15 close update

Broken record again. Received a MA sell and a mechanical color sell. No EDT buy this time.

We did have an inside day I usually consider that bullish, however we had a -16.68 drop in momentum vs a drop of 7.91 Spx points. That calls for a lower price. If the market was to follow the DAX level we would be at SPX 2044 or Spy 204.5. My call is a sharp down at some point Thursday.

Jerry EOM position challenge.

**************************************************************************

Monday close update.

Received a MA sell and a mechanical color sell . However you can count 5 waves down and a EDT signal also posted. I think we need to watch Dax for weakness, need at least Spx 2097 to get the bearish juices flowing. No charts tonight.

**********************************************************************************

Still think we are near a cycle high and one more day could put the MFI into OB and the DPO giving a better signal.

30 CD Cycle looks about right. On 2 -25 we hit a high and closed 6-8 points below the high.

On 3-23 high closed 6-8 points below high.

On 4-23 high close 6-8 points below high with following.

A cycle H+H+H look very good here. I expect a few days of strong weakness

.

Is this a top? Probably not because the 4.94% model would have us at Spx 2160 today.

I have a 4td MA on the MFI, very weak here. A better fit would have been O.B.

Jerry

Sunday, April 19, 2015

NO technical damage YET!

Other then the NYA we have not had the technical damage we would hope for.

I have a chart with $DAX over $SPX both are holding, but $Dax did plunge first and all eyes will be on it tonight.

I also have a $DAX lower in that chart with the 50dma just to show you we need a big break in the trend is going to change. The money flow did take a crazy dip on Thursday close

Erik Hadik says we are in for heavy selling I hope he is right.

I have a chart with $DAX over $SPX both are holding, but $Dax did plunge first and all eyes will be on it tonight.

I also have a $DAX lower in that chart with the 50dma just to show you we need a big break in the trend is going to change. The money flow did take a crazy dip on Thursday close

Erik Hadik says we are in for heavy selling I hope he is right.

Wednesday, April 15, 2015

2 signals

Thursday close. 2 signals. We had an inside day with a down day considered bullish by me.

I also have a short the rally signal.

If we rally strongly Friday then it is a short.

*************************************************************

Right from the open this was wrong.

I also have a short the rally signal.

If we rally strongly Friday then it is a short.

*************************************************************

Right from the open this was wrong.

I get a sell if we take out and close under SPX 2094.

To be honest I have had 8 wip buys and sells in the last

weeks.

When one direction finally takes it will be a big move.

I’m neither bullish or bearish yet. Why “Wall of Worry is

back”

Low interest rates and free money World wide.

If retail sells are strong it will move the market.

IE good news could plunge the market, because bad news has

been holding it up.

Ps Monday we had an

EDT close calling for ideal -

low am and high close Tuesday that worked.

OF course the chart has to look like a EDT, ( just a formula

only half works, but does

Alert me.)

Subscribe to:

Posts (Atom)