Bloomberg reports that once support failed that traders had to puke their accounts into a dead market. Is this tax selling or panic.

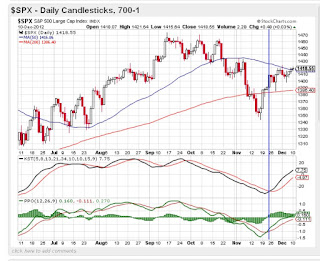

I don't know but my chart on the right tells a story of overbought and over

sold.

Sorry it's not clearer but forced to use dial up.

So on 12-18 the day of the high at 697.11 we then have gone almost straight down to my CIT line. The next 2 days was big drops. Here we are again

under the cit line will Monday offer a big drop?

BTW my spread sheet has a lower low in sight.

See what Monday offers.

Jerry

Look for the high of 2013 in the 2nd week of January. 6th to 9th !

Trending the SP500 SPX using proprietary cycles. A mechanical program (excel formula's) and the use of Advanced Get (Elliot waves) to both visually show what my spread sheet offers and how Advanced Get understands it. I'm also using a MOON COUNT that has been working nicely! Use at your own risk to supplement your own work. Jerry

Sunday, December 30, 2012

Friday, December 28, 2012

EOM -EOY rally

Looking for EOY and EOM rally.

Thursday turn should have legs.

Charts if you look at uvol and my cit line and note we have had 2 days of strong reaction.

We came to rest above it.

This is a tale of two indicators.

The Spx showing signs of weakness nad the OEx holding the fort.The fort will win.

I have a 144TDH on the Dec 31st and next hit on the 9th of Jan 2013.I think the HOY is in that second week of Jan 2013.

Happy New Year.

Jerry O

Thursday turn should have legs.

Charts if you look at uvol and my cit line and note we have had 2 days of strong reaction.

We came to rest above it.

This is a tale of two indicators.

The Spx showing signs of weakness nad the OEx holding the fort.The fort will win.

I have a 144TDH on the Dec 31st and next hit on the 9th of Jan 2013.I think the HOY is in that second week of Jan 2013.

Happy New Year.

Jerry O

Friday, December 21, 2012

Calls for more down,maybe

Just how much the day changed.

This snap was taken at 11am and looked like a crash day.

As you can see by the close the vix had improved

second chart.

We also had buying start to appear after lunch. With all the news on Cliff if we didn't crash there then I find it hard to see Monday down.

If we look at the $CPCE it suggested a bottom was coming so was that it?

I just don't have enough data on my spread sheet to suggest we were overbought enough yet.

As we rallied I kept getting only one indicator in sell mode out of 3 so I need to be suspect that many will not see this as a buying opportunity.

Stay tuned.

Jerry

Wednesday, December 19, 2012

P/C 2.45 Big move possible

All I know is it's triple witch. We have a high P/c ratio could help us move again.

Move where I don't know. Today a reaction day for me, and tomorrow I have the 20TD of the 40TDC but that could have been today. Closing on the lows of the day and a inside day seems bullish.

I'm over bought on 1 indicator again. Had we rallied today I probably would have been very bearish.

Looking back at the last 4 Triple witchs I see rallies. This week of course we started strong so does that mean we finish stronger? Triple witch who knows but we are due for as triple witch plunge. Can't remember last one.

Max pain $oex.x last I seem was 635.

Good luck,

Jerry O

Move where I don't know. Today a reaction day for me, and tomorrow I have the 20TD of the 40TDC but that could have been today. Closing on the lows of the day and a inside day seems bullish.

I'm over bought on 1 indicator again. Had we rallied today I probably would have been very bearish.

Looking back at the last 4 Triple witchs I see rallies. This week of course we started strong so does that mean we finish stronger? Triple witch who knows but we are due for as triple witch plunge. Can't remember last one.

Max pain $oex.x last I seem was 635.

Good luck,

Jerry O

Sunday, December 16, 2012

Monday reversal- P/C 2.49

Pat my back time. If you took the 9:40-9:45 time and did opposite you had a winner. Blush I over slept.

Monday I look for a reversal to the up side with a possible 10:30 Low. I think 1404-1405 Spx

Reason one, my parabolic indicator is flashing a low.

The P/c ratio 2.49 offers a big move. but real direction unknown since above 3.00 is better for direction.

The Vix as shown in this chart is in the down area with the crossing of MA so a pullback is in order.

The vix is also touching upper band.

One of charts below shows it. Last chart.

Blue circles just point out bottoms and green point out tops but their is a time factor so we have a little room to rally

Fear and greed look neutral.

My sheet was overbought several days ago so this backoff could offer a higher prices for a few days and this is OE week.

These charts below have me worry longer term.

If you look at what I will call a frackass because it's not a real fractal but has some haunting indicators. If we don't turn around we could get in a plunge real fast.

Most think we will rally after the WH comes to a deal and we probably will have a knee jerk.

But when you wake up you will say what is good about me paying more taxes. For starters a $65 Obama care fee will be coming soon. Not a tax Oh O.K.

Here we have a P&F chart with a flag at 1390

and a target of 1250.

This will happen sooner than later.

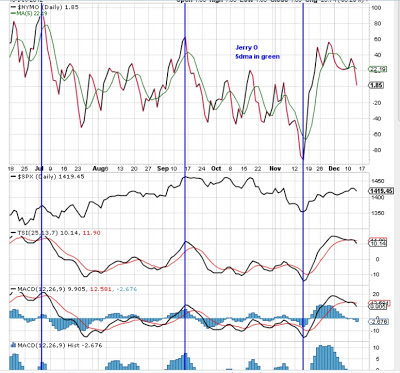

Here is the McCellan. I don't try to put spark plugs into the McC and tune it up.

All I do is look at it as a chart with my indicators on it.

Based on that it is on a sell even with histogram

combo MACD.

Even the cross overs are not good. How fast can this change I don't know but I have it on the watch list.

Monday I look for a reversal to the up side with a possible 10:30 Low. I think 1404-1405 Spx

Reason one, my parabolic indicator is flashing a low.

The P/c ratio 2.49 offers a big move. but real direction unknown since above 3.00 is better for direction.

The Vix as shown in this chart is in the down area with the crossing of MA so a pullback is in order.

The vix is also touching upper band.

One of charts below shows it. Last chart.

Blue circles just point out bottoms and green point out tops but their is a time factor so we have a little room to rally

Fear and greed look neutral.

My sheet was overbought several days ago so this backoff could offer a higher prices for a few days and this is OE week.

These charts below have me worry longer term.

If you look at what I will call a frackass because it's not a real fractal but has some haunting indicators. If we don't turn around we could get in a plunge real fast.

Most think we will rally after the WH comes to a deal and we probably will have a knee jerk.

But when you wake up you will say what is good about me paying more taxes. For starters a $65 Obama care fee will be coming soon. Not a tax Oh O.K.

Here we have a P&F chart with a flag at 1390

and a target of 1250.

This will happen sooner than later.

Here is the McCellan. I don't try to put spark plugs into the McC and tune it up.

All I do is look at it as a chart with my indicators on it.

Based on that it is on a sell even with histogram

combo MACD.

Even the cross overs are not good. How fast can this change I don't know but I have it on the watch list.

Friday, December 14, 2012

McClellan looks Ominious

I have no call for Friday. I didn't like the action today ( 3:30) that call to the WH stopped what could have been a good oversold buy.

Will ponder this chart.

Many crossovers that make the market look weak.

I may try a scalp.

My thoughts do the opposite of 9:40-9:45 since this is S3 yellow.

Will ponder this chart.

Many crossovers that make the market look weak.

I may try a scalp.

My thoughts do the opposite of 9:40-9:45 since this is S3 yellow.

Wednesday, December 12, 2012

K.I.S.S.

Update Thursday:

Had a $3 profit at 3:30 and was trying to sell zoom zoom up ( that damn white house).

Made only $1.2 per but love to win.

I looked for a rally today as I said yesterday.

I had hoped to get overbought but only one of my 3 indicators turned positive.

We have been up 5 days in a row and surely can be 6.

I seen no volume or any change in anything to confirem todays rally but the rally is not over.

I did buy a few Oex puts on a gut feeling based more on this chart.

We have hit this brick wall area 5 times. We have the same candle as circled.

My thought is we could pull back for 1 1/2 days at this time.

Don't marry options sell if a profit.

The Fed has nothing to offer but does the White House.

Today I had a cycle hit H to H I hope.

Jerry O

Had a $3 profit at 3:30 and was trying to sell zoom zoom up ( that damn white house).

Made only $1.2 per but love to win.

I looked for a rally today as I said yesterday.

I had hoped to get overbought but only one of my 3 indicators turned positive.

We have been up 5 days in a row and surely can be 6.

I seen no volume or any change in anything to confirem todays rally but the rally is not over.

I did buy a few Oex puts on a gut feeling based more on this chart.

We have hit this brick wall area 5 times. We have the same candle as circled.

My thought is we could pull back for 1 1/2 days at this time.

Don't marry options sell if a profit.

The Fed has nothing to offer but does the White House.

Today I had a cycle hit H to H I hope.

Jerry O

Monday, December 10, 2012

Bullish Charts with P/c Oex 3.74

Starting off with the Oex p/c ratio @ 3.74 not always but usually offers a big move I suspect up.

Chart to left is in bull town what comes next sooner or later bear town.You can stay overbought

longer than your money will last.

This is a problem that the RR's are coming back. A cross of that red line could spook a rally.

Spx with buy signals weeks ago and holding.

The strongest group is Cyclical or one of them and that is bullish as a basic group.

Chart to left is in bull town what comes next sooner or later bear town.You can stay overbought

longer than your money will last.

This is a problem that the RR's are coming back. A cross of that red line could spook a rally.

Spx with buy signals weeks ago and holding.

The strongest group is Cyclical or one of them and that is bullish as a basic group.

Wednesday, December 5, 2012

Not very bearish here

All my friends are bearish. Sure this AGET shows

a W4 abc, sure the AGET bias went to a sell.

We see a series of pitchforks. We see what I think will hold 1400 SPX or 1393 worst case.

Sure we have a lot of crossovers on MA's. ready to kill this market.

But my spreadsheet doesn't agree.

The Vix is hitting 17.XX right where the last low appeared.

We have a 55TDL Wednesday but the oversold condition we had should have us hit the current high again for a double top at least.

Still in cash not ready for puts yet. Not investment advise.

Jerry

a W4 abc, sure the AGET bias went to a sell.

We see a series of pitchforks. We see what I think will hold 1400 SPX or 1393 worst case.

Sure we have a lot of crossovers on MA's. ready to kill this market.

But my spreadsheet doesn't agree.

The Vix is hitting 17.XX right where the last low appeared.

We have a 55TDL Wednesday but the oversold condition we had should have us hit the current high again for a double top at least.

Still in cash not ready for puts yet. Not investment advise.

Jerry

Sunday, December 2, 2012

Astro by Gabriella

A friend of Trendsby3 having a proud day in

Tel Aviv working the Astro.

You can contact her at (below) or a link in favorites on right.

http://gabriella-mittelman.com/

Tel Aviv working the Astro.

You can contact her at (below) or a link in favorites on right.

http://gabriella-mittelman.com/

Gabriella best to you.

Jerry

Friday, November 30, 2012

Getting OB

Starting to get overbought.

This chart shows you can stay OB for many moons.

My spreadsheet is getting close to numbers I like to see.

I think we need a little more time like Dec 2nd but stay vigilante ,

I hope 1424ish will be top end.

Tell me what the boyz in DC are doing?

We could be looking at buy the rumor sell the news.

50 dma is creating resistance.

This chart shows you can stay OB for many moons.

My spreadsheet is getting close to numbers I like to see.

I think we need a little more time like Dec 2nd but stay vigilante ,

I hope 1424ish will be top end.

Tell me what the boyz in DC are doing?

We could be looking at buy the rumor sell the news.

50 dma is creating resistance.

Wednesday, November 28, 2012

Still looks up

Lets start out with the bullish look. Here we have the Rail Roads still climbing from the 11-16 low.

Today should have been the 144TDL from May 1st-2012

The most at this time is a daily scalp here and their.

This is the Elder Impulse chart and still in the green despite the drop so far.

The CCI and MACD not bearish either.

Looking at this break or not, we are hanging in there and well within the limits. The brick wall was hit but with EOM rally coming I can't get to bearish.

The vix is quiet.

The bearish look is Advanced Get gave a sell bias.

Two days in a row of inside days- unknown

The Oex PC after too days low numbers returned

to more normal 2.03 perhaps making the other 2 days equal.

The fools in Washington DC playing games with our money!

A break of SPX 1370, not expected.

Today should have been the 144TDL from May 1st-2012

The most at this time is a daily scalp here and their.

This is the Elder Impulse chart and still in the green despite the drop so far.

The CCI and MACD not bearish either.

Looking at this break or not, we are hanging in there and well within the limits. The brick wall was hit but with EOM rally coming I can't get to bearish.

The vix is quiet.

The bearish look is Advanced Get gave a sell bias.

Two days in a row of inside days- unknown

The Oex PC after too days low numbers returned

to more normal 2.03 perhaps making the other 2 days equal.

The fools in Washington DC playing games with our money!

A break of SPX 1370, not expected.

Tuesday, November 27, 2012

More up

More bricks in the wall, stopping at resistance. I don't think this is a double top here but could keep us from 1420.

With today decline ( Monday 26th) that killed my OB thoughts.Will see how this resistance acts.

Inside day today is bullish to me.

Oex p/c @ .78 unknown.

As I said yesterday the high is ahead of us and will add could be early Dec. Yes Christmas and holiday sales are strong but will create buyers remorse in January 2013 and the tax man in Washington DC is licking his chops.Beware!

With today decline ( Monday 26th) that killed my OB thoughts.Will see how this resistance acts.

Inside day today is bullish to me.

Oex p/c @ .78 unknown.

As I said yesterday the high is ahead of us and will add could be early Dec. Yes Christmas and holiday sales are strong but will create buyers remorse in January 2013 and the tax man in Washington DC is licking his chops.Beware!

Sunday, November 25, 2012

On hold.

http://money.cnn.com/data/fear-and-greed/?iid=H_INV_QL

My thoughts

"As far as, can I pick a CIT here, no I can't, who can?

Sure we have a trin of .42 my source, and a Oex P/C of .58 both a rare treat and extrmemes in my book are bearish but I have everything else on the cusp.

A market that was that OS, should get at least OB.

If you take the average 5td trading points and divide

by 2 it suggests a 2-3 more td top.

I have a 144 tdL Tuesday that could be a high or 1 day event dn.

Maybe one more day will clear the air."

My thoughts

"As far as, can I pick a CIT here, no I can't, who can?

Sure we have a trin of .42 my source, and a Oex P/C of .58 both a rare treat and extrmemes in my book are bearish but I have everything else on the cusp.

A market that was that OS, should get at least OB.

If you take the average 5td trading points and divide

by 2 it suggests a 2-3 more td top.

I have a 144 tdL Tuesday that could be a high or 1 day event dn.

Maybe one more day will clear the air."

Tuesday, November 20, 2012

Monday, November 19, 2012

Sunday, November 18, 2012

I will stay long...

I think this say's it all. You need to study this chart.

BTW I was surprised we took out Thursday low and had an outside day. Not a favorite day as most are bearish. I made $1.20 on 1 option oex 615C.

I have now moved to the next week 615 oex C

again.

Jerry

From CNN http://money.cnn.com/data/fear-and-greed/?iid=H_INV_QL

Will add to right for link under favorites!

BTW I was surprised we took out Thursday low and had an outside day. Not a favorite day as most are bearish. I made $1.20 on 1 option oex 615C.

I have now moved to the next week 615 oex C

again.

Jerry

From CNN http://money.cnn.com/data/fear-and-greed/?iid=H_INV_QL

Will add to right for link under favorites!

Friday, November 16, 2012

Get Long

Putting my technical skills on the line.

This is a good place to get long for a Short term rally.

Personally I think the low was yesterday Thursday and Friday should open firm and not look back.

#1 upvol up an a down day is bullish

#2 trin .68 I have. bullish

#3 All of yesterday charts. bullish

#4 todays charts. P&F looking at 1390 .

Has lowered the longer term to 1250 from 1290

Here we have a nice fractal where pink line was crossed to bottom and like wise in the second circle close to the same size.

My indicators are seeing the area around 11-25-11

and 5-18-12 where we had sharp rallies.

Cycles are looking for some movement.

This is for fun and games.

This is a good place to get long for a Short term rally.

Personally I think the low was yesterday Thursday and Friday should open firm and not look back.

#1 upvol up an a down day is bullish

#2 trin .68 I have. bullish

#3 All of yesterday charts. bullish

#4 todays charts. P&F looking at 1390 .

Has lowered the longer term to 1250 from 1290

Here we have a nice fractal where pink line was crossed to bottom and like wise in the second circle close to the same size.

My indicators are seeing the area around 11-25-11

and 5-18-12 where we had sharp rallies.

Cycles are looking for some movement.

This is for fun and games.

Wednesday, November 14, 2012

Rally Time

I know many are looking for a crash here but I fail to see anything but an oversold market.

You need volatility to get a crash and vix is low.

Yes we are in AGET wave 3 a crash wave but don't see it with other works.

Bullish view #1 Chart on left has big red volume where other bottoms have formed.

#2 Even my $naz model is now in the OS area

Gann box wants to stop drop.

Can .618 stop the drop?

Can that tangle of angles stop the drop?

My pride and job the overbought/ oversold sheet.

WE ARE IN BUY MODE.

Jerry O

Volume and oversold models say up to Friday.

You need volatility to get a crash and vix is low.

Yes we are in AGET wave 3 a crash wave but don't see it with other works.

Bullish view #1 Chart on left has big red volume where other bottoms have formed.

#2 Even my $naz model is now in the OS area

Gann box wants to stop drop.

Can .618 stop the drop?

Can that tangle of angles stop the drop?

My pride and job the overbought/ oversold sheet.

WE ARE IN BUY MODE.

Jerry O

Volume and oversold models say up to Friday.

Wednesday down

Quick review at 1am ET.

Future are up sharply but I still think we are down Wednesday.We do have the vix +spx saying UP

not shown.

#1-My bear view is this chart shows the volume in bearish mode under blue lines

#2 We had a outside day today, enlarge chart to view the record. No perfect but close. Most technical analyses says inside and outside days are useless or undecided, I think different.

Here is the AGET view of the count. Other then the pitch fork trail not much as far as direction.

My parabolic indicator also looks for a down or at least a lower low. for Wednesday.

As far as being OB/OS I'm close to being OS but not there yet in the SPX, nor the Nas. We need a thud down.

Future are up sharply but I still think we are down Wednesday.We do have the vix +spx saying UP

not shown.

#1-My bear view is this chart shows the volume in bearish mode under blue lines

#2 We had a outside day today, enlarge chart to view the record. No perfect but close. Most technical analyses says inside and outside days are useless or undecided, I think different.

Here is the AGET view of the count. Other then the pitch fork trail not much as far as direction.

My parabolic indicator also looks for a down or at least a lower low. for Wednesday.

As far as being OB/OS I'm close to being OS but not there yet in the SPX, nor the Nas. We need a thud down.

Saturday, November 10, 2012

Option week, but trend still down

**********************************************************************************

"I go with 1266 :-* then 1166 or 20% 1266 Spx sure, 1166 iffy

The short term rally should be as Rxxxx indicates 1400 expiry. I have 1402-1410 and a rare out side chance we could see 1419 (a very strong sell.)

The Spx seems to be front running today more balance Monday.

Hadik 14-16 high

I have a 144TDL 26/27th

So far upvol peaked at 1PM or 74%"

*********************************************************************************

Saturday Current thoughts market could pull back Monday offering a buy and push higher into Thursday

possible Friday. The more we drop Monday (if we do) the less upside. Drops will be fast in a bear market. I gave my targets above.

Here we have the Treasury Bond and $$$

playing togetherness.

click and chart to enlarge.

As I said last week 9 chart below away's the

Dollar has bottomed .

How can this be good?

The RailRoad Index topped, then gapped down ,

later the gap was filled and weakness is the norm.

New York Advance rolling rolling

long standing target 1266 as marked.

My view of John Murphy 13/34 ema

We are in the yellow so look left for the future.

Macd and PPO confirming

The P&F I built had a target 1350 now lowered

to 1290. Kind of say's 1350 is real possible.

Why not on the 1290 bandwagon here?

Seems a little too soom.

The P&F has a 25 point miss so far as I can tell

with my experience .

What is this? This is my buy- sell model on the NDX.

It is not on a buy yet.

Do not risk money on this unless it agree's with your own work. Fun and games only.

So in the land of majic how would this work.

First you need to get oversold (18) taking a position long (calls) then on a rally if after 6 Trading days it not above 50 sell cash.

If after 6 trading days it's heading for 70 then consider selling on a down turn 73 for sure.

Will this get the top no remember this is option model sell premium.

The mood of market seems to come back to 30

in green a fast move and calls again with same 6 TD scenario. As we all know the market can stay over bought for a long period of time so no (puts) are suggested unless 73 - 70 is breached.

Thursday, November 8, 2012

Trend still dn but OS

Today was the 30 TDL of the 10-40 tdc. Was it the final low not by a long shot.

We could of course bounce here looking at the oversold condition of the market. The horizontal lines tell the worst depths.

Jerry O

We could of course bounce here looking at the oversold condition of the market. The horizontal lines tell the worst depths.

Jerry O

Monday, November 5, 2012

$ has bottomed

$USD has bottomed.

Reading Eric Hadik free news letter, he say's it all about the $.

Looking at my chart the trend indicator I use has crossed to a buy.

The blue down trend line maybe gave a better buy.

I would guess a strong $ rally will push stocks down and killing already weak earnings.

Jerry O

Subscribe to:

Posts (Atom)