I have no call for Friday. I didn't like the action today ( 3:30) that call to the WH stopped what could have been a good oversold buy.

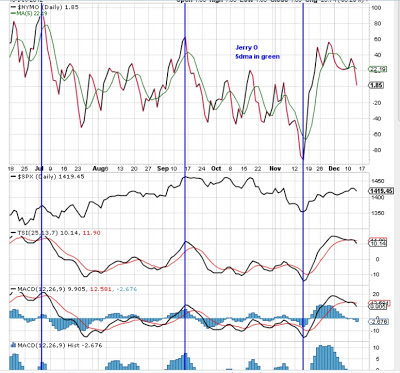

Will ponder this chart.

Many crossovers that make the market look weak.

I may try a scalp.

My thoughts do the opposite of 9:40-9:45 since this is S3 yellow.

Trending the SP500 SPX using proprietary cycles. A mechanical program (excel formula's) and the use of Advanced Get (Elliot waves) to both visually show what my spread sheet offers and how Advanced Get understands it. I'm also using a MOON COUNT that has been working nicely! Use at your own risk to supplement your own work. Jerry

Friday, December 14, 2012

Wednesday, December 12, 2012

K.I.S.S.

Update Thursday:

Had a $3 profit at 3:30 and was trying to sell zoom zoom up ( that damn white house).

Made only $1.2 per but love to win.

I looked for a rally today as I said yesterday.

I had hoped to get overbought but only one of my 3 indicators turned positive.

We have been up 5 days in a row and surely can be 6.

I seen no volume or any change in anything to confirem todays rally but the rally is not over.

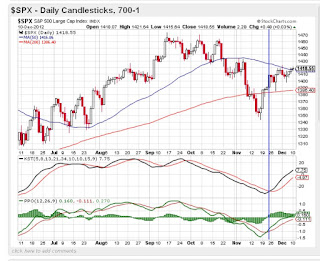

I did buy a few Oex puts on a gut feeling based more on this chart.

We have hit this brick wall area 5 times. We have the same candle as circled.

My thought is we could pull back for 1 1/2 days at this time.

Don't marry options sell if a profit.

The Fed has nothing to offer but does the White House.

Today I had a cycle hit H to H I hope.

Jerry O

Had a $3 profit at 3:30 and was trying to sell zoom zoom up ( that damn white house).

Made only $1.2 per but love to win.

I looked for a rally today as I said yesterday.

I had hoped to get overbought but only one of my 3 indicators turned positive.

We have been up 5 days in a row and surely can be 6.

I seen no volume or any change in anything to confirem todays rally but the rally is not over.

I did buy a few Oex puts on a gut feeling based more on this chart.

We have hit this brick wall area 5 times. We have the same candle as circled.

My thought is we could pull back for 1 1/2 days at this time.

Don't marry options sell if a profit.

The Fed has nothing to offer but does the White House.

Today I had a cycle hit H to H I hope.

Jerry O

Monday, December 10, 2012

Bullish Charts with P/c Oex 3.74

Starting off with the Oex p/c ratio @ 3.74 not always but usually offers a big move I suspect up.

Chart to left is in bull town what comes next sooner or later bear town.You can stay overbought

longer than your money will last.

This is a problem that the RR's are coming back. A cross of that red line could spook a rally.

Spx with buy signals weeks ago and holding.

The strongest group is Cyclical or one of them and that is bullish as a basic group.

Chart to left is in bull town what comes next sooner or later bear town.You can stay overbought

longer than your money will last.

This is a problem that the RR's are coming back. A cross of that red line could spook a rally.

Spx with buy signals weeks ago and holding.

The strongest group is Cyclical or one of them and that is bullish as a basic group.

Subscribe to:

Comments (Atom)